31+ ideal mortgage to income ratio

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Highest Satisfaction for Mortgage Origination.

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Web The ideal debt-to-income ratio should not exceed 36 of your gross monthly income.

. And yours is coming 33 which is absolutely within the range. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward housing costs.

Back-End DTI Ratios Two types. Web Lenders have different definitions of the ideal debt-to-income ratio DTIthe portion of your gross monthly income used to pay debtsbut all agree that a lower DTI is better. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. To get the back. Most home loans require a down payment of at least 3.

Your front-end or household ratio would be 1800 7000 026 or 26. Web Gross monthly income of 6500 x 45 2925 can be applied to recurring debt plus housing expenses. Gross monthly income of 6500 x 31 2015 can be applied to.

The 2836 rule of thumb for mortgages is a guide for how much house you can comfortably afford. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Save Real Money Today. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Kaela Ryan As a general guideline 43 is the highest DTI ratio a borrower can have.

That is the highest ratio allowed by large lenders unless they. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. These figures may vary slightly based on one lender to.

Web An ideal debt-to-income ratio therefore is any percentage that falls below 36 to err on the side of caution. Web The 2836 rule is a good benchmark. Multiply your total monthly gross income by 31 percent to determine your maximum monthly housing expenses.

Web Typically in the case of a mortgage your debt-to-income ratio must be no higher than 43 to qualify. Web Say your monthly gross income is 7000 and your housing expenses are 1800. Compare Offers From Our Partners To Find One For You.

Web Debt To Income Ratio Dti What It Is And How To Calculate It Get Instantly Matched With Your Ideal Home Loan Lender. It Only Takes Minutes to See What You Qualify For. Web Key Takeaways.

Compare Offers From Our Partners To Find One For You. Web What Your Debt to Income Ratio Means. Web How Does DTI Debt to Income Ratio Impact Mortgage Rates Asked by.

The 2836 DTI ratio is based on gross income. A 20 down payment is ideal to lower your monthly. Lenders prefer to see a debt-to.

Web Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI ratio of 037 or 37. Web The amount of money you spend upfront to purchase a home. These expenses include your principal and interest payment.

Apply Online To Enjoy A Service. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

India News August 16 31 2022 Vol 3 Issue 3 By India News Issuu

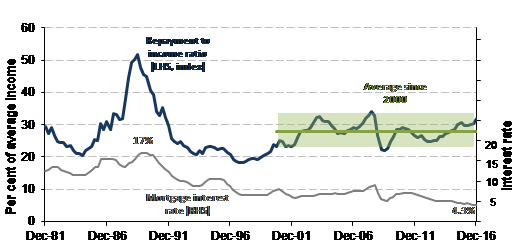

Understanding Housing Affordability Openforum Openforum

Mortgage Income Calculator Nerdwallet

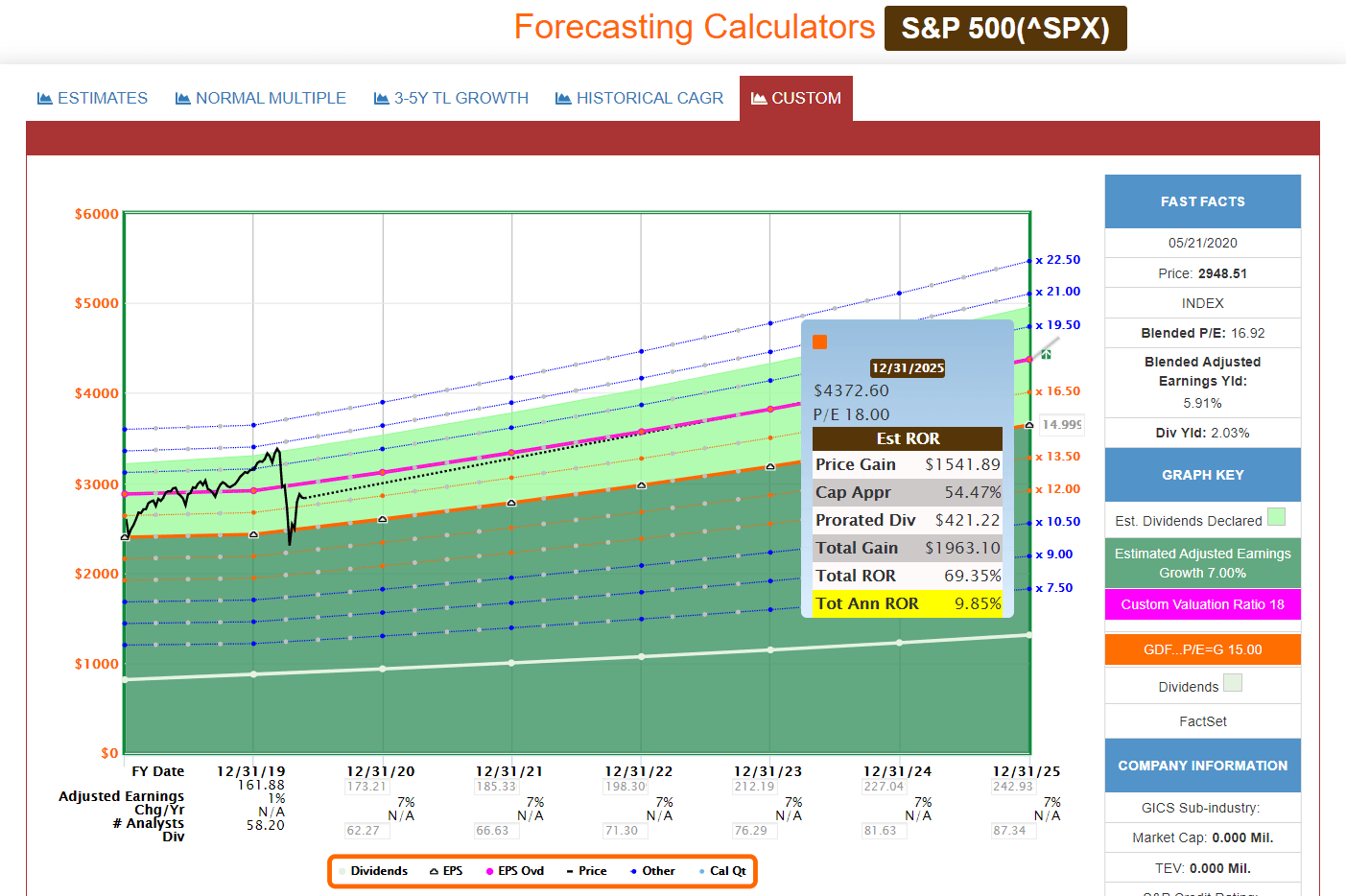

3 Safe Blue Chip Growth Stocks Retirees Can Trust Seeking Alpha

How Much House Can You Afford Calculator Cnet Cnet

Indispensable Real Estate Buyers Agent Checklist For Homebuyers True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Document

31 Ways To Save For Halloween Sofi

Mortgage How Much Can You Borrow Wells Fargo

The Financial Budget Manual By Aginfo Issuu

Full Article Linking Integration And Housing Career A Longitudinal Analysis Of Immigrant Groups In Sweden

An Analysis Of The Uk Development Industry S Role In Brownfield Regeneration Emerald Insight

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How Much Of My Income Should Go Towards A Mortgage Payment

How Much To Spend On A Mortgage Based On Salary Experian

What S An Ideal Debt To Income Ratio For A Mortgage

Axos Financial Inc Axos Financial Inc Fixed Income Investor Presentation February 2022 Nyse Ax Filed Pursuant To Rule 433 Registration No 333 253797 Issuer Free Writing Prospectus Dated February 16 2022 Relating